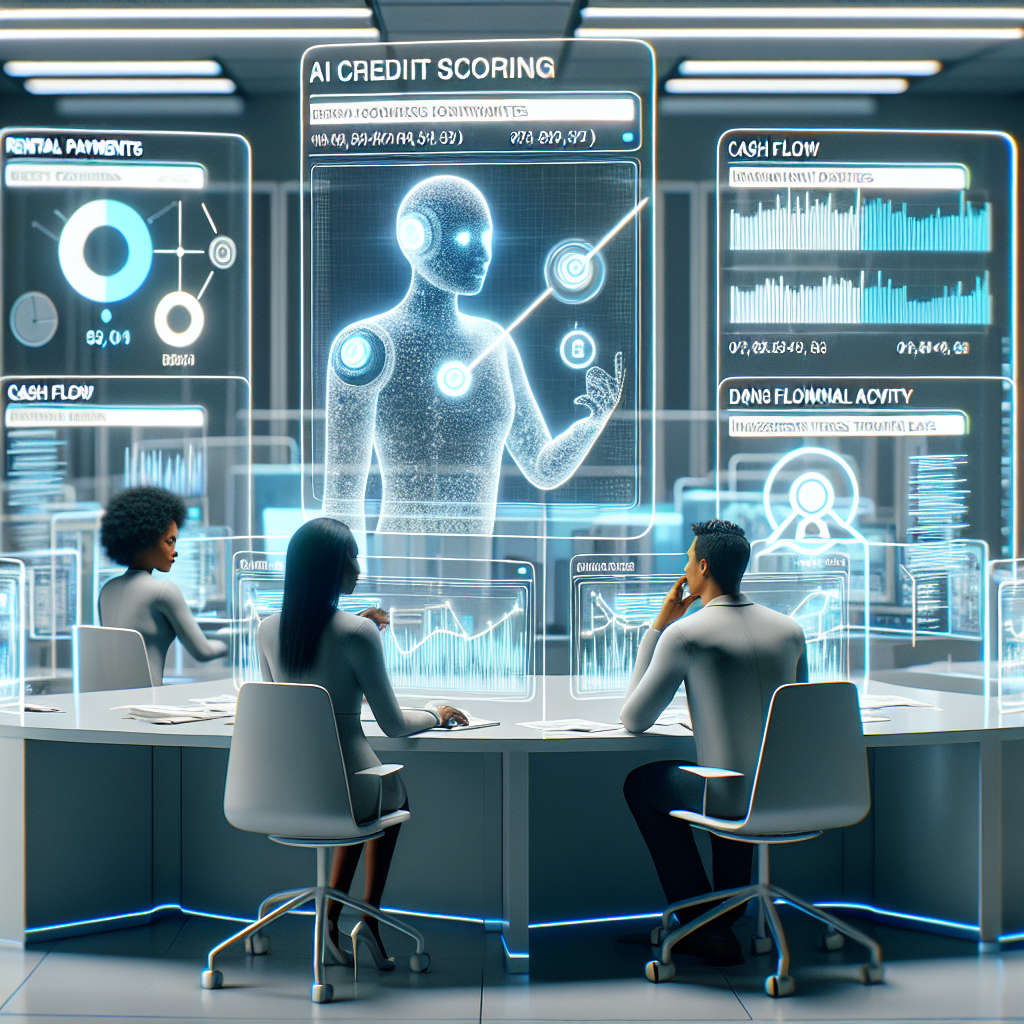

AI-Powered Fair and Fast Credit Scoring

The Future of Credit Scoring: Fairer, Faster, and Powered by AI

Credit scores. Mention these words, and you might picture an old-time clerk buried in paperwork deciding your loan fate or nervously wonder if skipping that daily coffee is hurting your financial reputation. Credit scoring has long been the gatekeeper of loans, mortgages, and financing—like the Hogwarts Sorting Hat, but for your wallet.

Good news: that Sorting Hat is getting a high-tech makeover. Artificial Intelligence (AI) is here, promising not only faster and smarter credit scoring but truly fairer decisions—no magic wand needed.

The Evolution of Credit Scoring: Beyond the Traditional

Traditional credit scoring relies on just a handful of factors: payment history, amounts owed, length of credit history, new credit, and credit mix. It’s like a friend who only knows five subjects and thinks that’s enough to understand your entire story. But millions—such as young adults without credit history, immigrants, or people paying rent in cash—remain “credit invisible” under this system. Essentially, no visible credit means no access, which is like judging a CEO candidate solely on their high school grades. That’s where AI changes the game.

How AI is Reshaping Credit Decisions

1. Broader, Smarter Data Integration 📈

AI goes beyond traditional metrics by incorporating:

- Rental payment history, demonstrating consistent adult financial responsibility.

- Utility bill payments, signaling timely obligations.

- Cash flow analytics (with permission), revealing steady income and spending habits.

- Buy Now, Pay Later (BNPL) activity, which FICO is officially including in scoring models by Fall 2025.

- Proprietary transaction data from lenders to build a comprehensive financial profile.

In short, AI crafts a richer, more accurate financial snapshot compared to outdated black-and-white credit reports.

2. Faster, More Transparent Decisions ⚡

Forget waiting weeks for loan approval. AI accelerates the process to minutes or seconds, bringing you closer to your dream home or car swiftly.

Plus, explainable AI (xAI) ensures transparency by clearly communicating why a credit decision was made, so you understand the “why” behind approvals or denials.

3. Fairer and More Inclusive Lending 🤝

By expanding data sources and challenging old assumptions, AI fosters inclusion for:

- Gig workers managing variable income.

- Young adults starting their credit journey.

- Immigrants and unbanked populations seeking financial access.

The World Economic Forum highlights AI’s potential to welcome millions previously excluded from credit opportunities.

The Role of Machine Learning and Continuous Improvement

AI isn’t static—it learns continuously from every transaction and repayment, adapting swiftly to economic changes and consumer behavior patterns to improve credit accuracy.

Challenges and Ethical Considerations

Despite the promise, caution is essential:

- Data Privacy: Integrating more personal data requires robust security to prevent breaches.

- Algorithmic Bias: AI must be carefully monitored to avoid reinforcing existing prejudices.

- Regulatory Compliance: Staying updated with evolving laws is critical to avoid penalties.

Ethical practices ensure AI doesn’t become a harsh gatekeeper but instead a fair ally in credit decisions.

The future of credit scoring is evolving to be fairer, faster, and smarter—all thanks to AI. While it’s not perfect yet, the transformation promises a more inclusive financial landscape where your credit story reflects the full picture. Remember—the best player in this new game is you: stay informed, make smart financial choices, and maybe enjoy the journey along the way.